As a business owner, filing Form 941 is crucial to reporting employment taxes, including federal income tax withholding, Social Security tax, Medicare tax, and Additional Medicare tax. When managing your payroll services using QuickBooks, filing your taxes with the software can be quite convenient. Filing QuickBooks form 941 to the IRS is determined by the amount of federal taxes you pay each year and the type of business.

Today, we will discuss how to file and print in QuickBooks Desktop and Online, along with the deposit schedule and the threshold amount for each.

New to QuickBooks or need assistance from accounting experts? Don’t worry; dial +1-866-409-5111 and connect with QuickBooks ProAdvisors. The experts are also available to handle the task on your behalf.

Understanding QuickBooks Form 941

All the non-agricultural businesses that have paid more than $1000 in federal taxes must file Form 941. You need to file this form through the IRS quarterly. The form is available in each QuickBooks Online and QuickBooks Desktop and is supported to file and even print.

The lookback period for Tax Year 2025: July 1, 2021-June 30, 2024.

Check the table provided below to see whether you have a semi-weekly or monthly deposit.

| Deposit Schedule | Threshold for Each Deposit Schedule |

| Semi-Weekly | Businesses must file form 941 semi-weekly and report more than $50,000 in taxes during the lookback period. |

| Monthly | In the lookback period, businesses reported less than $50,000 in taxes. |

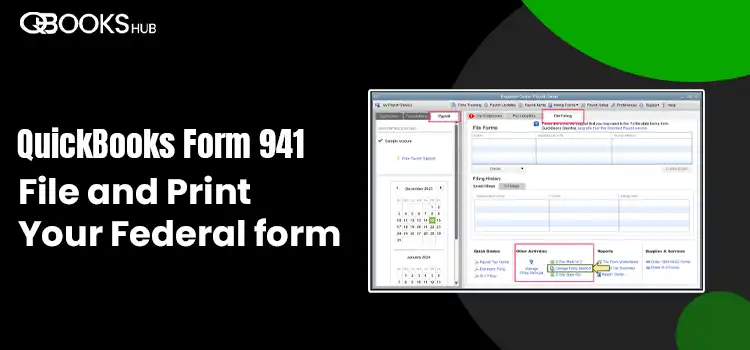

How to File Form 941 in QuickBooks Desktop & Online

Now, you know what QuickBooks Form 941 is and when you should file it. This section covers step-by-step instructions or a complete guide on how to file and print the form in QuickBooks desktop and QuickBooks Online.

In QuickBooks Desktop

If you need to e-file and e-pay for your state taxes in QuickBooks Desktop Payroll Enhanced, follow the steps mentioned below:

Step 1: Set up the Federal e-file and e-pay in QB

Ensure you have set up your QuickBooks Desktop for Federal e-file and e-pay.

Step 2: E-pay Your Federal Taxes

Note the following information to ensure you make the federal payments on time:

- If your federal tax liability exceeds $100,000 during a liability period, you must pay the IRS EFTPS website the following business day.

- Make your e-payments two banking days before the due date before 5:00 PM PT. If you are making the payment after this time, you must use the IRS EFTPS website.

Follow these steps to e-pay in QuickBooks Desktop:

- In QuickBooks, click on Employees from the top menu bar.

- Hit on Payroll Centre.

- Select the Pay Liabilities tab.

- Move to the Pay Taxes & Other Liabilities and choose the liabilities you want to pay.

- Now, hit on the View/Pay button.

- Review your liabilities details to ensure they are correct.

- Hit on E-Pay.

- In the redirected window, type your 4-digit EFTPS PIN and other required login information.

| Note: In case you have recently changed your bank account for e-payment, enter your new PIN. |

- Click on Submit.

- Once the confirmation notice appears, you can take a print, which will be signed by Intuit. It will receive your request and submit your e-payment to the correct agency.

Step 3: E-file Your Federal Forms

Let’s file the federal Form in QuickBooks Desktop:

- Navigate to the QuickBooks’ Employees menu.

- Choose Payroll Tax Forms and W-2s and then click on Process Payroll Forms.

- From the list of federal forms, choose the one you need to file.

- Hit on Create Form.

- Choose the period you are filing for, and then hit OK.

- Now, go through the entire Form to ensure there are no issues. Moreover, you can select Check for errors and then make the necessary changes required.

- Click on Submit Form and then E-file.

- Enter the PIN of the 10-digit IRS and adhere to the on-screen instructions to continue filling out the Form.

| Note: When e-filing a W-2, you don’t need a PIN. |

- Now, you will receive a confirmation email within 1-2 business days. You can check the status by clicking on Check e-file or e-pay status.

In QuickBooks Online

This section explains how you can pay and file your federal form 941 state and local taxes if you are electronically paying in QuickBooks.

Step 1: Set up federal e-file and e-pay

Before you can e-pay or e-file payroll taxes using QuickBooks, make sure you complete your payroll tax setup. If you’re all set up, skip to step 2.

Step 2: E-pay your federal taxes

Keep in mind that the IRS and state agencies have different processing times. Therefore, you need to e-pay the taxes five business days before the due date.

- Select Taxes from the top menu bar of QuickBooks.

- Click on Payroll Taxes.

- Choose Payments.

- Under the Action Needed section, you will a list of taxes that needs to pay. Upcoming due taxes will appear in Coming Up. If you are looking for some specific taxes, you can select Filter for the faster process.

- Hit on Pay on the taxes you want to pay.

| Note: Some states might block you when the payment is late. In such a case, you must contact the state to make the payment. |

- Check and ensure the selected payroll bank account is the correct bank account in QuickBooks Desktop.

- Now, review the payment mode and choose Payment History.

| Note: In case you want to review a tax payment you have done outside of QuickBooks, click on Record prior tax payments. |

Step 3: E-file your federal forms

The employment tax form 941 typically due on each calendar quarter. You will receive the reminders from QuickBooks when these are due.

- Check and ensure you have paid all the taxes related to the forms you are filing.

- Choose Payroll Taxes from the Taxes menu.

- You will see a list of forms and files under Action Needed. You will due later forms in the Coming Up section. To file your form faster, click on Filter to find your forms.

- Choose File and then select the form you want to file.

- Ensure to select the checkbox for File Electronically.

- Hit on Submit.

- Under Done, you will see filed.

- You can also take a print if needed.

How to Print Form 941 in QuickBooks Desktop & Online

To print your federal form 941 after filing, you need to check it in the previously filed forms. Then, you can save it as a PDF and print it out.

Let’s get an overview of how to print the form in QuickBooks Desktop and the Online version.

In QuickBooks Desktop

Whether you submitted the form electronically or manually, you can access the form immediately and print it out. To view your previously filed or saved forms:

- Hit on Employees at the top.

- Click on Payroll Centre.

- Choose the File Forms tab.

- Move to the Filling History section.

- Now, select the Save Filings or E-Filings tab.

- Choose the form you want to print.

- Now, take a print of the form.

In QuickBooks Online

Follow the below steps to view and print your tax forms by choosing whether you e-filed the form or manually:

If you e-filed your tax forms:

- Go to Taxes> Payroll Tax.

- Click on the Fillings tab.

- Under the ACTION NEEDED or COMING UP section, view the tax forms you currently filed. Or you can also select Archived forms and filings for the forms filed in the past. If the previous forms are available, click on Preview to view the form you haven’t filed yet.

If you filed Form 941 manually:

Step 1: First, Archive the Form

- Go to Taxes> Payroll Tax.

- Move to the Fillings tab.

- To save or archive the file, choose File.

- Choose the period and click on Archive.

Step 2: Preview your Form

- Select Taxes> Payroll Tax.

- Click on the Fillings tab.

- Tap on Resources and then Archived forms and filings.

- Now, filter the form type you want to see from the drop-down menu.

- Choose the form name and click on View.

Summary

After following this comprehensive guide, you must file your QuickBooks Form 941 and save it as a PDF or get a printed copy in both Desktop and Online versions. If you face any interruption during the process or get stuck somewhere, you must contact QuickBooks professionals. Dial +1-866-409-5111 and connect with a QuickBooks ProAdvisor now!

Frequently Asked Questions

Yes, QuickBooks allows you to file and print form 941 for each product of QuickBooks Online Payroll and QuickBooks Desktop Payroll.

If QuickBooks is your primary accounting software to file form 941, you can access the report in a few steps: Go to Taxes> Payroll Tax> Quarterly Forms and choose 941 Form. Further, select the period from the drop-down and hit on View.

In QuickBooks, go to the Taxes> Payroll Tax to print form 941. Now, choose the Quarterly Forms or View and Print Archived Forms to see the archive forms from previous periods> click on the 941 link. Choose Preview> either download it in PDF format or get a print of it.

In QuickBooks Online, navigate to Settings> Payroll Settings, then click on Edit next to Federal tax. Now, select Edit from How often do you pay your taxes? Now, choose the form you file, the frequency of how often you pay the taxes and the effective date. Finally, click on Save and then Done.

Go to Taxes>Payroll Tax. Move to the Filings tab and check your current tax forms in the ACTION NEEDED or COMING UP section. You can also click on Resources and then Archived form to see or file the past forms.