The payroll updates are crucial for the most current and accurate rates, tax laws for supported provincial and federal tax tables, payroll tax forms, and eFILE options to active Payroll subscription customers. In QuickBooks Desktop, you can easily update your payroll services and make sure you are complaint.

The latest payroll updates are only available in QuickBooks Desktop 2024 or QuickBooks Desktop Enterprise Solutions 24.0. Review this article and learn how to download and install the 2024 payroll services update.

We will also help you address the problems you may encounter during the updates after updating the payroll services.

Why Should You Update Payroll Services?

If you are an active payroll subscription, updating the payroll services to the latest release is crucial and offers various benefits when filing taxes or returns. Check out the reasons why you must keep the payroll services up-to-date with the current tax table tax rates:

- It makes sure your tax deduction occurs as per the latest tax regime.

- Tax deductions or returns may vary depending on the latest tax table and tax rates. It helps with accurate tax filings and ensures you are compliant with the latest tax rules.

- When updating the payroll service in QuickBooks Desktop, also make sure the security patches and the latest features are applied to the payroll services section.

How to Obtain Payroll Updates and Fix Related Issues?

Continue to this section and check out how to advance the payroll tax table and make sure it is up-to-date with the recent tax table, policies,, and current tax rates. Let’s proceed with the below steps carefully:

The current payroll tax table version

12034003 on QuickBooks Desktop 2024 is released on December 19, 2024 and is effective from January 1, 2025 to July 31, 2025.

Check the current version you have

Released on December 19, 2024, QuickBooks Desktop 2024 version 12034003 will be in effect from January 1, 2025, until July 31, 2025.

In QuickBooks, choose My Payroll Service from the Employees menu, followed by Tax Table Information.

The initial three figures beneath The tax table version that you are using should show as 12034003 since it reflects your tax table version.

| Reminder: To download the tax table update, make sure you are using QuickBooks Desktop 2024 or QuickBooks Desktop Enterprise Solutions 24.0. |

How to get the payroll tax table updates?

You can schedule the automatic payroll updates if you subscribe to QuickBooks Payroll so that QuickBooks downloads payroll updates automatically as soon as they are available.

In QuickBooks, you can also download the latest payroll updates anytime manually:

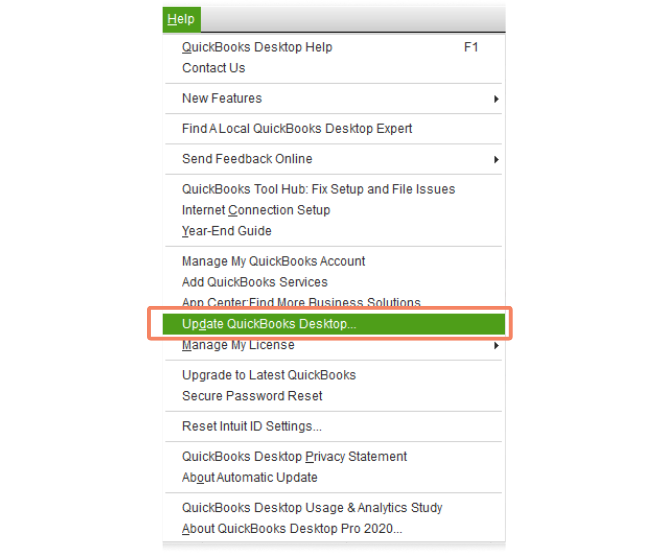

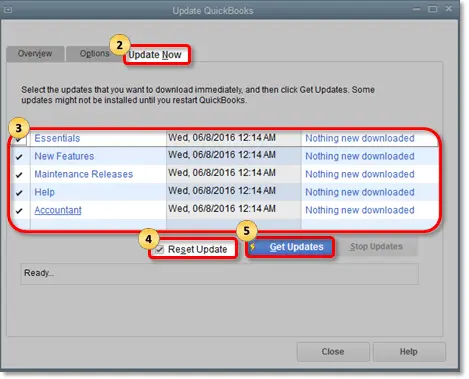

- Launch QuickBooks Desktop and select Help.

- Click on Update QuickBooks.

- Move to the Update Now tab.

- Hit on Get Updates.

- Mark the checkbox for Entire Updates.

- Choose File and then select Exit.

- Once done, restart your computer to take effect.

| Note: The 2024 tax table adjustments must be finished within the software; there won’t be a web patch accessible. |

What’s included in the current payroll tax table update?

For the January 2025 tax table update, there are several TD1 changes from the July 2024 payroll tax table update.

| Effective Date | 1/1/2025 | 7/1/2024 |

| Tax Table version # | 12034003 | 11934004 |

| TD1 Amounts | ||

| Federal | 16,129.00 | 15,705.00 |

| AB | 22,323.00 | 21,885.00 |

| BC | 12,938.00 | 12,580.00 |

| MB | 15,969.00 | 15,780.00 |

| NB | 13,396.00 | 13,044.00 |

| NL | 11,067.00 | 10,818.00 |

| NS | 11,744.00 | 11,481.00 |

| NT | 17,842.00 | 17,373.00 |

| NU | 19,274.00 | 18,767.00 |

| ON | 12,747.00 | 12,399.00 |

| PE | 14,250.00 | 14,250.00 |

| QC | 18,991.00 | 18,056.00 |

| SK | 18,991.00 | 18,491.00 |

| YT | 16,129.00 | 15,705.00 |

| ZZ (employees outside Canada) | 0 | 0 |

| Effective Date | ||

| Tax Table version # | ||

| Canada Pension Plan (CPP) – outside Quebec | ||

| Maximum Pensionable Earnings | 71,300.00 | 68,500 |

| Basic Exemption | 3,500.00 | 3,500.00 |

| Contribution Rate | 5.95% | 5.95% |

| Maximum Contribution (EE) | 4,034.10 | 3,867.50 |

| Maximum Contribution (ER) | 4,034.10 | 3,867.50 |

| Employment Insurance (EI) – outside Quebec | ||

| Maximum Insurable Earnings | 65,700.00 | 63,200 |

| Premium EI Rate (EE) | 1.64% | 1.66% |

| Premium EI Rate (ER) (1.4*EE) | 2.296% | 2.32% |

| Maximum Premium (EE) | 1,077.48 | 1,049.12 |

| Maximum Premium (ER) | 1,508.47 | 1,468.77 |

| Effective Date | 1/1/2025 | 7/1/2024 |

| Tax Table version # | 12034003 | 11934004 |

| Quebec Pension Plan (QPP) | ||

| Maximum Pensionable Earnings | 71,300.00 | 68,500.00 |

| Basic Exemption | 3,500.00 | 3,500.00 |

| Contribution Rate | 6.40% | 6.40% |

| Maximum Contribution (EE) | 4,339.20 | 4,160.00 |

| Maximum Contribution (ER) | 4,339.20 | 4,160.00 |

| Employment Insurance (EI – Quebec only) | ||

| Maximum Insurable Earnings | 65,700.00 | 63,200.00 |

| Premium EI Rate (EE) | 1.31% | 1.32% |

| Premium EI Rate (ER) (1.4*EE) | 1.834% | 1.85% |

| Maximum Premium (EE) | 860.67 | 834.24 |

| Maximum Premium (ER) (1.4*EE) | 1,204.94 | 1,167.94 |

| Quebec Parental Insurance Plan (QPIP) | ||

| Maximum Insurable Earnings | 98,000.00 | 94,000.00 |

| Contribution Rate (EE) | 0.49% | 0.49% |

| Contribution Rate (ER) (1.4*EE) | 0.69% | 0.69% |

| Maximum Contribution (EE) | 484.12 | 464.36 |

| Maximum Contribution (ER) (1.4*EE) | 678.16 | 650.48 |

| Commission des normes du travail (CNT) | ||

| Maximum earnings subject to CNT | 98,000.00 | 94,000.00 |

Troubleshoot the Common Payroll Update Issues

Proceed with the below steps if your TD! Amounts are not updated after installing the latest tax table or overall payroll updates:

a. Is it on or after the tax table effective date?

If you downloaded tax table version 12034003 on or after December 19, 2024, you will not be able to see updated amounts until the tax table becomes effective on January 1, 2025.

After January 1, 2025, if you downloaded product updates with the new tax tables:

- Have you ever had to manually adjust TD1 amounts before or after setting up a new employee?

- If you’ve ever manually updated the TD1 amounts for an employee, the new tax table will not override any previously adjusted amounts. You must update the TD1 amounts manually going forward.

- Do any of your employees have original TD1 amounts setup?

- QuickBooks Desktop will automatically update TD1 amounts only for employees with original amounts set up for previous tax tables.

b. Have you had to manually adjust the TD1 amounts at any time in the past or after setting up a new employee?

If you ever have updates with TD1 amounts for your employees, the new tax table will not update or operate on any previously adjusted amounts. Therefore, you will need to manually update TD1 amounts going forward.

c. Are any of your employees set up over the basic TD1 amounts?

Don’t worry; QuickBooks Desktop will automatically update your TD1 amounts only for the employees who has the basic amounts for the previous tax tables.

| Note: In case your QuickBooks payroll update not working or you encounter any error such QuickBooks error PSXXX or QuickBooks error 15XXX, you must consult this with QB professionals or visit our detailed article on the website. |

Summary

This is the end of this article, which includes step-by-step instructions on the Received QuickBooks payroll update and what is included in the current tax table update. If you face any issues after updating, you can also perform a security check and get the related information.

However, if you fail to receive the update or have any related queries, it is advisable to consult QuickBooks professionals. Dial +1-866-409-5111 and talk to an expert now!

Frequently Asked Questions

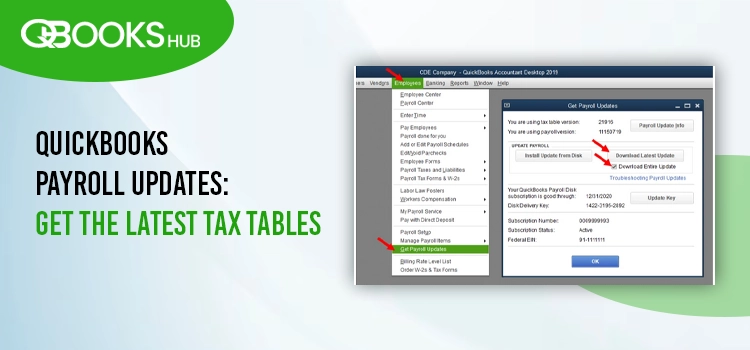

Proceed with the below steps to update your QuickBooks Desktop manually:

• Go to Employees at the top.

• Select Get Payroll Updates.

• Hit on Download Entire Update.

• Click on Update.

• You will see an informational window saying the download is complete.

Using an outdated version of QuickBooks software, incorrect paycheck information, or network connectivity issues can be why you fail to update the payroll services. The payroll updates may also get hampered when the Windows Firewall or other security applications block the software processes.

You may see ‘The File Exists’ error when updating payroll, paying your taxes, or opening state or federal forms due to having the enough Windows permissions to run these operations or might not running the QB program with all the admin rights.

When trying to update the payroll services, you may encounter QuickBooks error PS032 due to various reasons such as:

• Any damages in the CPS folder

• Incorrect internet connectivity settings in your computer

• The incorrect Windows firewall configuration may prevent QuickBooks Desktop payroll updates.

Learn how you can categorize payroll in QuickBooks Desktop:

• Navigate to Payroll and click on Payroll Settings.

• Hit on Payroll Categories. Now, you will see a list of common pay categories that are available already in QuickBooks. You can delete all of them and create new ones that match your business requirements.

• Hit on Add to create a new pay category.

• Name this category and select Save.